By Shogo Ishida and Yosuke Yoshida, Co-CEOs, EMURGO Africa

As many nations across Africa struggle to regulate the cryptocurrency business, South Africa, the continent’s most industrialized economy, has emerged as a frontrunner in making legislations to govern the industry in the past 2 years.

Key Takeaways:

- South Africa leads Africa in regulating crypto

- New crypto laws are driving Web3 adoption

- New regulations are boosting investor confidence in Web3

- South Africa is Africa’s top destination for crypto use in retail

What Happened in the Last 2 Years?

On October 19, 2022, the South African Financial Sector Conduct Authority (FSCA) officially classified crypto assets as a financial product. This categorization subjected crypto assets to regulation by the FSCA, falling under section 1(h) of the Financial Advisory and Intermediary Services Act (FAIS) Act. This is the first such legislation in Africa.

This followed a proposal by FSCA in November 2020 that aimed at ensuring cryptocurrencies are treated like financial products, and that firms offering crypto-related services must apply for a license.

According to the 2022 designation, individuals providing advice or intermediary services concerning crypto assets must be authorized as financial services providers or representatives thereof. November 30, 2023 was set as the deadline for obtaining such a license. The regulator warned that doing crypto operations without applying for registration in the designated time period could lead to a $510,000 fine or imprisonment.

The FAIS Act defined crypto assets as non-central bank-issued digital units of value that utilize cryptographic and distributed ledger technologies. This declaration followed a proposal and draft legislation by the FSCA in November 2020 to bring crypto asset-related financial services providers under regulatory oversight. A subsequent public consultation elicited feedback from 22 stakeholders, resulting in 94 individual comments.

Prior to this declaration, South Africa faced increased risk of reputational damage following a report by the Paris-based Financial Action Task Force (FATF) in October of the previous year. The report highlighted the absence of crypto asset regulation in the country as a significant deficiency in the context of anti-money laundering and counter-financing terrorism efforts.

Accompanying the declaration is an FSCA policy document that provides explanatory notes, transitional details, and outlines plans for a regulatory and licensing framework for crypto assets.Simultaneously, the regulator released a draft general exemption, inviting comments until the beginning of December.

This exemption aims to facilitate the transition of existing crypto asset sector participants to the new regulatory regime. Under the regulations, cryptocurrency exchanges and wallet providers are required to register with the country's financial intelligence agency, the Financial Intelligence Centre (FIC). They must adhere to strict anti-money laundering (AML) and counter-terrorism financing (CTF) measures, including customer due diligence procedures and transaction monitoring.

Furthermore, cryptocurrency exchanges are mandated to implement robust cybersecurity protocols to safeguard against hacking and other security threats. These measures are designed to enhance consumer protection and mitigate the risks associated with digital asset transactions. On March 13, the South African government said it will be licensing 60 crypto firms to operate in the country, signaling a proactive approach toward embracing the digital asset landscape while ensuring user and investor protection. The regulator received applications from 300 firms since its new framework commenced last year. “We are processing those licensing applications and we’re doing so in a phased kind of manner given the numbers,” FSCA commissioner Unathi Kamlana told Bloomberg.

Stablecoin Regulation

To hedge against volatility, store value, and make efficient transfers, South Africa has two stablecoins - ZARP and ZARC - pegged to the South African Rand (ZAR). ZARP went live in 2021 on the OVEX crypto exchange while ZARC was launched in Q1 2023 and is available on the non-custodial crypto app SentiPay.

The Intergovernmental Fintech Working Group in South Africa has initiated analytical research into the utilization of stablecoins, aiming to assess potential use cases and formulate an appropriate policy and regulatory approach by the end of 2024.

“As we license and supervise, we will discover that perhaps there are gaps that cannot be closed by the existing regulatory framework, the FAIS Act,” Kamlana said. “And we might need to build on that as we discover what those are.” In February, the government said it will add stablecoins as a particular type of crypto, according to the Treasury department's Budget Review paper (pdf).

The group is also deliberating on the ramifications of tokenization on domestic markets, wherein real-world assets (RWAs) such as securities are represented on a blockchain. By December, the group intends to release a discussion paper elucidating the regulatory considerations associated with tokenization and the implementation of blockchain-based financial market infrastructure.

Highest Crypto Spending Country in Africa

According to the Meltwater Digital 2023 Global Overview Report conducted across four African nations, South Africans have the highest annual purchasing power in cryptocurrencies, surpassing Nigeria, often regarded as the continent's crypto hub.

The crypto report shows the average yearly expenditure of crypto traders in South Africa stands at $51.38. This figure eclipses the average annual spending in Morocco, Kenya, and Nigeria, which are recorded at $33.07, $16.08, and $14.76, respectively. South Africans’ willingness to spend more in crypto is largely attributable to their upper middle-class economic status, with a GDP per capita (Purchasing Power Parity basis) of $14,624. This is compared to Morocco’s $8,852, Nigeria’s $5,408, and Kenya’s $5,211, according to the World Bank.

In addition to their robust purchasing power, South Africans also lead the continent in terms of the percentage of internet users aged 16 to 64 who hold cryptocurrencies, with a notable 18% adoption rate. Following closely behind are Nigeria at 13%, Kenya at 12%, and Morocco at 4.5%.

The Meltwater research also shows that South Africa leads Africa in NFT expenditure. South Africa, Morocco, Kenya, and Nigeria have an NFT annual average spend of $16.06, $9.96, $6.78, and $5.58 respectively.

Crypto Adoption is on the Rise

South Africa has an estimated 5.8 million crypto users, or 9.4% of the country’s total population, according to Triple A data.

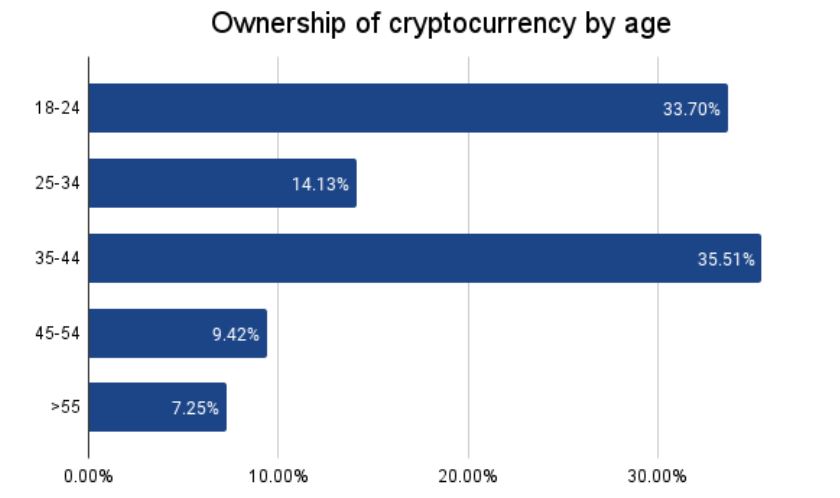

Analyzing digital currency ownership by income, Triple A reveals that 77% of South African digital currency holders earn an annual income of $24,000 or less. This indicates that digital currencies are predominantly owned by individuals within the low to middle income brackets.

A substantial majority of digital currency holders in South Africa fall within the 18-44 age bracket, accounting for 83% of all owners. Conversely, only 7% of digital currency holders are aged 55 and above, suggesting that digital currencies are predominantly embraced by South African millennials, the report says.

SOURCE: Triple A

SOURCE: Triple A

An impressive 86% of South African adults are familiar with digital currencies. This marks a noteworthy increase of 20 percentage points from 2021 to 2022, signaling a growing awareness and acceptance of digital currencies within the country. South African digital currency owners are likely to be highly educated, 46% of them hold a bachelor’s degree or higher. Majority of the survey respondents (63%) are seeking to increase their holdings of crypto.

In South Africa, there's a growing acknowledgement of digital currency as a secure asset and a viable alternative to traditional national currencies. Triple A data indicates that over 46% of digital currency owners possess digital assets valued at over $500 per user. Additionally, a notable portion (12%) of crypto holders in the country possess holdings exceeding $5,000 per person.

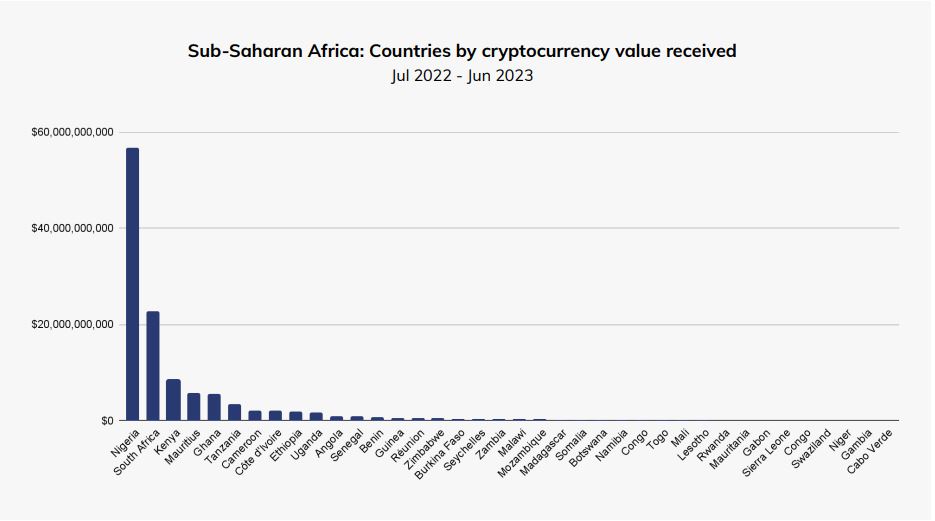

The 2023 Geography of Cryptocurrency Report by Chainalysis shows that South Africans traded over $20 billion worth of crypto in the 12 months to June. This makes them second after Nigeria in terms of crypto value received.

SOURCE: Chainalysis

SOURCE: Chainalysis

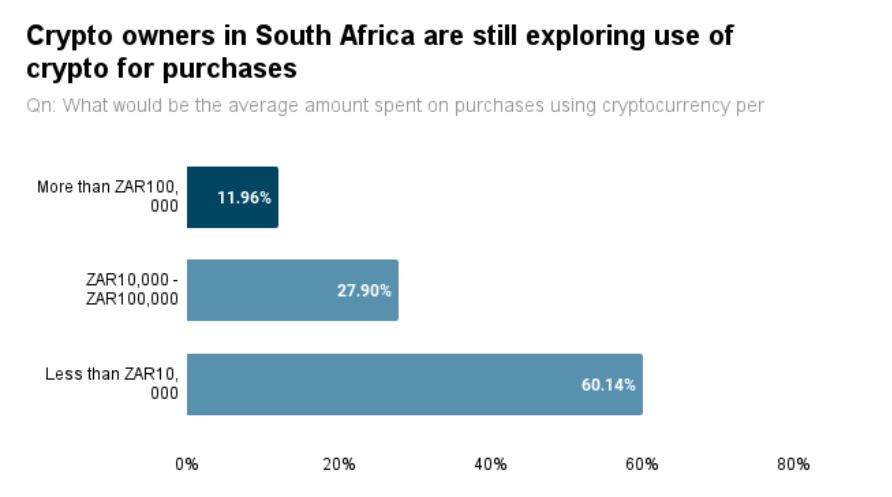

Africa’s Top Destination for Crypto Use in Retail According to Triple A data, a significant portion of South African digital currency owners (52%) are actively utilizing digital currency for purchases, indicating a notable shift towards its integration as a mainstream form of payment.

Furthermore, approximately 40% of digital currency spenders are utilizing over $500 worth of digital currency for monthly purchases. At least 81% of South African digital currencies respondents agree that businesses would stand to benefit from adopting digital currency payments.

In February 2023, South Africa’s grocery retailer Pick n Pay started accepting bitcoin payments officially via the Lightning Network. Lightning is a software protocol designed to speed up transaction times in the bitcoin network and reduce congestion. This followed a three-month pilot testing phase in 39 locations, and all of its 1,628 stores now accept the crypto.

This works by letting customers scan a QR code with their smartphones and accepting the South African rand’s bitcoin conversion rate at the time of payment. Customers will need a Bitcoin Lightning Wallet and the CryptoQR scanner app from crypto interoperability firm CryptoConvert, which is linked to it. CryptoConvert allows merchants to receive crypto payments using the Bitcoin Lightning Network without having to navigate the technical complexities and exchange rate volatility associated with crypto payments.

Last September, users of crypto exchanges Luno and VALR were allowed to shop at Pick n Pay and pay with crypto via CryptoConvert. VALR clients can transact directly from the app. Luno allows customers to buy groceries, airtime, bus tickets, and pay municipal bills with bitcoin at the till for free. In December, Binance also partnered with CryptoConvert to allow its users to pay for goods using crypto at Pick n Pay.

In November, South African fintech Stitch announced the launch of its ‘Pay with crypto’ payment solution that allows local businesses to accept cryptocurrency as payment for goods and services. This option allows deposits or transactions using crypto from VALR or Binance wallets. The startup targets online marketplaces, e-commerce platforms, gaming, trading sites, and travel service providers.

SOURCE: Triple A

SOURCE: Triple A

Top 10 Web3 Startups in South Africa

- VALR: A prominent crypto exchange platform in South Africa offering individual users and institutional investors to trade over 60 cryptocurrencies. VALR Pay allows users to pay for goods and services in crypto .

- Momint: South Africa’s first NFT marketplace. Makes the process of minting NFTs accessible. Enables digital creators, artists, and individuals to sell, auction, trade, and showcase their work as NFTs.

- Luno: Crypto exchange that allows users to buy, sell and trade cryptocurrencies. Luno wallet owners can pay for goods using crypto.

- Safcoin: Through Cryptovalley, its e-commerce platform, Safcoin allows small and medium-sized businesses to accept cryptocurrency payments.

- Web3 Sanctuary: Functions as an education technology (ed-tech) platform that equips aspiring developers with the knowledge and skills needed to work with Web3 technologies.

- Ovex: Another crypto exchange but acts as a private bank for crypto in South Africa, providing a platform for institutional investors and large-scale transactions.

- SentiPay: Positions itself as a non-custodial cryptocurrency wallet provider that caters to both consumers and merchants.

- Jambo Technology: Its goal is to be a Web3 super app, aiming to bring cryptocurrency and blockchain technology to the forefront in Africa, with South Africa being a key market.

- Blockpay Africa: Provides a payment solution using crypto. Focuses on integrating blockchain technology into everyday transactions.

- Blockkoin Exchange: Offers a platform for buying, selling, and trading various cryptocurrencies.

How Crypto Laws are Fueling Adoption Crypto laws in South Africa are playing a pivotal role in fueling the adoption of cryptocurrencies and other Web3 technologies within the country. Here’s how:

- Regulatory Clarity: Clear and well-defined regulations are providing certainty to investors and businesses operating within the crypto space. South Africa's regulatory framework offers guidelines for operating cryptocurrency exchanges and service providers, reassuring users about the legality and security of their transactions.

- Consumer Protection: By establishing regulatory standards, such as anti-money laundering (AML) and counter-terrorism financing (CTF) measures, the government is ensuring consumer protection. This is already building trust among users, encouraging more individuals to explore and invest in cryptocurrencies.

- Market Confidence: Properly regulated markets are more attractive to both local and international investors. With robust regulations in place, South Africa's crypto market is becoming more credible, leading to increased investor confidence and higher levels of participation.

- Institutional Involvement: Crypto regulations are paving the way for institutional investors and traditional financial institutions to enter the crypto market. This infusion of institutional capital not only increases liquidity but also legitimizes cryptocurrencies as viable investment assets.

- Innovation and Development: Regulatory frameworks that encourage innovation while ensuring investor protection foster the development of the crypto industry. South Africa's progressive approach to regulation is providing a conducive environment for startups and entrepreneurs to innovate and create new solutions in the crypto space.

- International Reputation: By implementing comprehensive crypto laws, South Africa enhances its reputation as a forward-thinking and attractive destination for crypto-related businesses and investments. This will likely lead to increased collaboration with international partners and bolster the country's position in the global crypto market.

DISCLAIMER: The information in this content (website or other form) does not represent an offer or commitment to provide any product or service. The analysis, opinions and estimates expressed in this content are those of the respective authors, and may differ from those of EMURGO Africa and/or other EMURGO Africa employees and affiliates. Copying, re-publishing or using this material or any of its contents for any other purpose is strictly prohibited without prior written consent from EMURGO Africa.