Thank you for visiting our blog post 🦙🌟

In sub-Saharan African (SSA) countries, the freedom of money transaction has increased over the past decade with the spread of mobile phones and the expansion of mobile money. However, challenges persist in the financial sector, such as limited access to bank accounts including mobile money accounts, and high barriers to lending for small and medium-sized enterprises (SMEs). Blockchain-based lending lowers interest rates, introduces new collateralization methods, and attracts more SME borrowers.

In this blog post, we overview the current status of financial inclusion, one of the central topics in development discussions, and look closer into digital and web3 lending services for individuals and SMEs in SSA.

Table of Contents:

Challenges in Access to Credits in Africa

Only less than 45% has access to financial account

World Bank Global Findex data1 shows that just 35 percent of people over the age of 14 in 28 countries in SSA had formal bank accounts in 2021a. Since this data includes higher income countries such as Mauritius (nearly 90%) and South Africa (85%), the average of low income countries in SSA is lower than 35 percent. For example, in Sierra Leone and Guinea, the percentage of respondents with a formal bank account is below 14 percent.

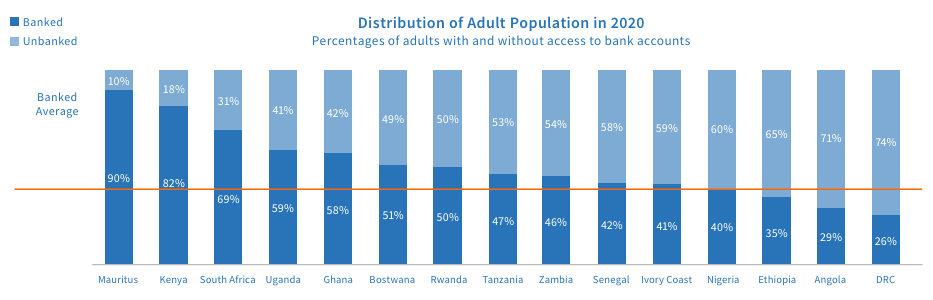

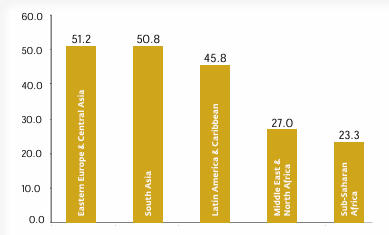

Figure 4.1. Access to Financial Account (% age 15+, 2021)

Source: Figure cited from The Global Findex Database 2021 by World Bank1

Compared to other regions, SSA has the lowest access to formal bank accounts (see Figure 4.1. above). Latin America, Southeast Asia, and the Middle East and North Africa (MENA) present the percentage of 57, 62, and 48 respectively, while the high-income regions of Europe and North America are at 92 percent and 58 percent respectively1.

The figure does not increase significantly by taking the mobile money accounts into account. In 2020, only 43 percent of Africans had any kind of bank account, including mobile money accounts2. For instance, Nigeria, Ethiopia, or the DRC continuously hold a low banking penetration, ranging from only 25 to 40 percent banked adults2. Overall, it is estimated that about 360 million adults in SSA do not have access to any form of a bank account including mobile money accounts2.

Figure 4.2. Percentage of Adults with And without Access to Any Financial Accounts in 2020

Source: Figure cited from Digital Banking in sub-Saharan Africa report by BPC2

SSA remains predominantly cash-based, with about 90 percent of payments and transactions conducted in cash. SSA accounts for one of the lowest credit and debit card penetration rates with 3 and 18 percent respectively2. Therefore, there is significant room for improvement in financial inclusion through digital tools, such as establishing credit scores for lending purposes, with great potential positive impacts on social development.

More than 80% of formal SMEs unmet financing needs

Access to credit for firms is the engine for private sector development. However, SSA also lags behind other regions in access to finance for firms, with only around 20 percent of firms having a bank loan or line of credit in 2020. And 83 percent of formal SMEs in the region have unmet financing needs3.

Figure 4.3. Access to Line of Credit or Loans from Financial Institution (% of Firms)

Source: Figure cited from Knowledge Guide by World Bank4

SMEs in SSA face hurdles in borrowing money because of a lack of collateral and poor credit history. Inadequate collateral was considered a very severe, major or moderate constraint by 83 percent of banks lending to SMEs5. A similar percentage of banks cited poor credit history as a constraint when lending to the sector5.

Figure 4.4. Factors Limiting Lending to Corporates and SMEs in The Last 12 Months (% of Responding Banks)

Source: Figure cited from Finance in Africa 2022 by European Investment Bank5

In 2022, African banks are increasingly worried about asset quality, which emerged after the pandemic. Banks expect to tighten credit standards again for their customers5. Standard Bank, Africa's biggest lender by assets, reported that its loan losses for the first half ended June 30 2023 jumped by more than 40%6.

In the past five years, 9,400 businesses have been deregistered in Kenya7 mainly because they could not access finances to run their normal operations8. The same reason led to the closure of over 600,000 MSMEs in Nigeria in 20229. Yet, most SMEs in Nigeria are not registered at all, meaning they are not credit eligible due to lack of data8.

Notes

a. The definition of access to formal bank accounts is percentage of respondents with an account (self or together with someone else) at a bank, credit union, another financial institution (e.g., cooperative, microfinance institution), or the post office (if applicable) including respondents who reported having a debit card (% age 15+).

References

1. The Global Findex Database 2021 | World Bank

2. Digital Banking in Sub-Saharan Africa | BPC

3. Recent Trends in Access to Finance in Africa | Making Finance Work for Africa (MFW4A)

4. Secured Transactions, Collateral Registries and Movable Asset-Based Financing | World Bank

5. Finance in Africa 2022 | European Investment Bank (EIB)

6. South Africa's Standard Bank sees high bad loans in second half | Reuters

7. 9,441 companies in Kenya close shop in five years | Business Daily

8. THE Web 3.0 Connect -September '23 | EMURGO Africa

9. 600,000 MSMEs shutdown in one year, Says NASME | The Guardian Nigeria News

Digital and Web3 Lending in Africa

While challenges of access to finance remain significantly in SSA, driven by substantial capital investments1, digital lending and web3 lending services have emerged and are working to solve this problem. Tech giants such as Safaricom, Vodacom, and MTN are no exception.

In SSA, financial services revenues are expected to grow by 10 percent per annum, reaching an estimated $230 billion in revenues by 2025 (excluding South Africa)2. The growth is led by increasing smartphone ownership, declining internet costs, expanded network coverage, and a young, fast-growing, and rapidly urbanizing population. The nimble fintech players are rapidly gaining traction in this lucrative market2. It is projected that retail/SME lending will have been the largest share of revenue among all financial services2. Although the revenue share is still small compared to other digital finance businesses, blockchain finance is growing fastest2.

Figure 4.5. Growth Rate of Financial Services Market Revenue by Product in Africa

Source: Figure cited from Fintech in Africa: The end of the beginning by McKinsey2

Digital lending starts from 2-6% monthly interest rate

We studied 39 digital lending providers in Africaa, among which 16 provide both businesses and individuals with loans, and 22 provide loans only for businesses3. Also 6 of them have offline agents while 33 do not have offline agents3.

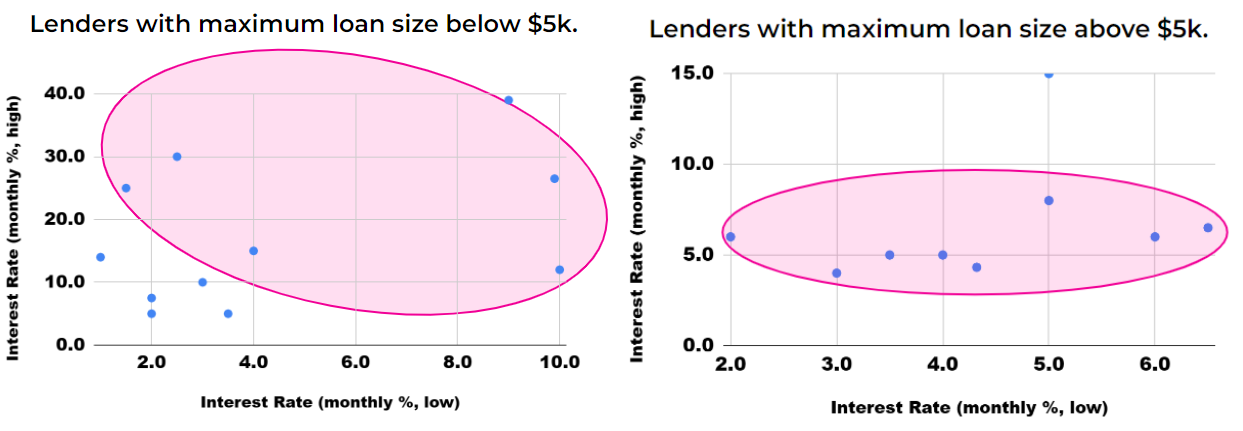

Figure 4.6. Monthly Interest Rate of Digital Lending Providers by Loan Size (%)

Source: Figure cited from EMURGO Africa 2023 Q2 Report by EMURGO Africa3

According to our researcha, for lenders with maximum loan size below USD 5,000, interest rate starts from 2-4 percent per month, and it goes larger than 10 percent and even 40 percent in some cases depending on the condition3 (see Figure 4.6 above). For lenders with maximum loan size above USD 5,000, the minimum interest rate varies between 2-6 percent per month, and maximum interest rate is below 10 percent per month in most cases3 (see Figure 4.6 above).

New and innovative products such as virtual savings and short-term credit supply products for individuals have popped up around the continent: M-Shwari by Safaricom in Kenya, M-Pawa by Vodacom in Tanzania, Mokash by MTN in Uganda and Rwanda. Table 4.1. below summarizes the products. In 2019 there were over 20 million virtual savings accounts that had been opened in the last five years compared to about 30 million deposit accounts in the banking sector4.

Table 4.1. Virtual Savings and Short-Term Credit Supply Products for Individuals

Source: Figure cited from Harnessing Africa's digital potential by Brookings4

SMEs face implicitly high interest charges by fintech giants

Fintech giants also expanded the lending products for SMEs. Table 4.2. below presents lending rates of those loan products. Many products offer a minimum interest rate of 5 percent per month, which is more expensive than commercial banks that offer double digit rates per annum5.

Actually, the rate is even more expensive than it appears. For instance, in the case of Flutterwave, failure for SMEs to refund the cash within 30 days, attracts further charges, and on average it could blow up to 60% per annum5. Also, while Safaricom’s Faraja for SMEs offers free business loans up to $700 per business for 30 days via its mobile money platform, those that fail to pay up within the moratorium period are struck with a suspension from the platform, followed by a debt-collection agency to recover the amount in default5.

Table 4.2. Lending Rates for SMEs by Big Fintech Companies

Source: Figure cited from THE Web 3.0 Connect -September '23 by EMURGO Africa5

Web3 lending interest rate ranges 2-6% per YEAR

Web3 lending platforms, on the other hand, provide credit at much lower rates (between 2 and 6 percent annually)5, and SMEs have been turning to seeking out loans with those services.

For example, widely known global DeFi platforms, AAVE and Compound, both provide loans of US dollar backed stable coins such as USDT, USDC, and DAI with the interest rate between 0.1-0.3 percent per month3. Such a low interest rate is achieved by automating the secured loan process without the need for an intermediary through a smart contract, a piece of code stored on a blockchain that runs once predetermined conditions are met5.

Also, while DeFi does not require anything but having a wallet, digital finance requires a personal ID and certain credit history and score to access loans3. Lending on blockchain helps lower interest rates, creates a new way of collateralization, and attracts more SME borrowers5.

Globally, more than $200 billion in loans was disbursed in 2021 from the largest Web3 lending platforms, and cumulative bad debt is currently roughly $1 million, despite significant volatility6. This puts the default rate at an insignificant 0.000005%5. The global Web3 space was valued at $934 billion in 20227, while the global retail banking market size was estimated at $1.9 trillion in the same year8.

While digital finance offers local currency loans, DeFi, in many cases, requires on- and off- crypto ramping costs in addition to transaction or gas fees3. In the next chapter, we look at the on- and off- crypto ramping solutions in Africa. New projects are expected to develop more convenient options for the web3 lending users in the region.

Notes

a. The list of 39 digital lending providers in SSA is available on page 10 of EMURGO Africa 2023 Q2 Report by EMURGO Africa.

References

1. 2022 Africa Tech Venture Capital Report | Partech

2. Fintech in Africa: The end of the beginning | McKinsey

3. EMURGO Africa 2023 Q2 Report | EMURGO Africa

4. Harnessing Africa's digital potential | Brookings

5. THE Web 3.0 Connect -September '23 | EMURGO Africa

6. Potential of Web3 | McKinsey

7. Crypto Losses in 2022 Report | Immunefi

8. Retail Banking Market Size To Worth USD 3,482.41 Bn By 2032 | Precedence Research

Thank you very much for reading this post 🧞✨

For downloading the full report, visit this page.

Follow EMURGO Africa for more information

EMURGO Africa invests and supports local Web3 projects in the region to adopt Cardano’s decentralized blockchain technology to build socially impactful solutions.

As a regional entity of EMURGO, the official commercial arm of Cardano, EMURGO Africa also runs a local Cardano accelerator in Africa, Adaverse, which accepts applications year-round.

For more up-to-date information on EMURGO Africa, follow the official channels listed below.

About EMURGO Africa

- Official Website: emurgo.africa

- X: @EmurgoAfrica

- Telegram: https://t.me/emurgoafrica