Thank you for visiting our blog post 🦚🌟

Among a wide range of applications of blockchain, the actual demand for the technology in Africa is centered on the use of cryptocurrencies for preservation of money value, cross-border remittance, and inter-continental payment for SMEsa.

In this blog post, we learn the current status of crypto demand in Africa and prospects. 🪂

Table of Contents:

- Nigeria, One of Top Crypto Adopted Countries

- Crypto as Attractive Means of Storing Value

- Crypto's Low Transfer Fee Attracts Immigrants and SMEs

Nigeria ranks second overall on Global Crypto Adoption Index

Between July 2022 and June 2023, SSA accounted for 2.3% of global transaction volume, and the region received an estimated $117B in on-chain value, among which Nigeria accounts for more than 50 percent of all value received in the region, followed by South Africa and Kenya1.

Figure 5.1. SSA Countries by Cryptocurrency Value Received (July 2022-June 2023)

Source: Figure cited from The Chainalysis 2023 Geography of Cryptocurrency Report by Chainalysis1

Nigeria is one of only six countries (Saudi Arabia, Vietnam, Nigeria, Spain, Taiwan, and Indonesia) whose crypto transaction volume grew during the last financial year ending June 20231. Its year-over-year volume growth is 9 percent, placing it third following Saudi Arabia (12%) and Vietnam (11.6%)1. Overall, Nigeria ranks second on Global Crypto Adoption Index, which is calculated based on the trade volumes of centralized, decentralized (DeFi), and P2P exchanges1. Other countries in the region ranking high on the index include Kenya (21), Tanzania (23), Ghana (29), South Africa (31), Egypt (34), Ethiopia (35), and Cameroon (41)1.

Figure 5.2. Global Crypto Adoption Index

Source: Figure created by author based on The 2023 Global Crypto Adoption Index by Chainalysis2

Local fiat depreciation making crypto an attractive means of storing value

As many countries in the region suffer from a decline in the value of their currencies against the US dollar (see Figure 5.3), continued inflation (see Figure 5.4), and rising debt, cryptocurrencies have become an attractive means to preserve value, maintain savings, and gain greater economic freedom1.

In 2022, small-scale importers in Kenya were hit hard by a scarcity of forex that forced banks to impose $1500 to $2000 daily limits3. Under limited availability of US dollars in the countries, cryptocurrencies, especially stablecoins pegged by US dollars, which are generally less volatile in price than other cryptocurrencies, have been gaining more attention and importance1.

It is likely that when the stablecoins are fully reserved by currency deposits, more consumers have the confidence to employ this tokenized cash for cross-border payments and corporate transfers, giving them access to the benefits associated with cryptocurrencies: instant settlement, low-cost transactions, greater security, and increased transparency4.

Figure 5.3. US Dollar to Local Currency Chart (Feb. 2022-Feb. 2024)

Source: charts cited from Free Currency Charts - Historical Currency Rates by Xe5

Figure 5.4. Consumer Price Index (Feb. 2023-Jan. 2024)

Source: 20 Million Indicators from 196 Countries by Trading Economics6; Note: CPI base year is different across countries: November 2009 = 100 in Nigeria; February 2019 = 100 in Kenya; 2021 = 100 in Ghana; December 2021 = 100 in South Africa; 2018/2019 = 100 in Egypt.

Crypto's low cross-border transaction fee attracts immigrants and SMEs

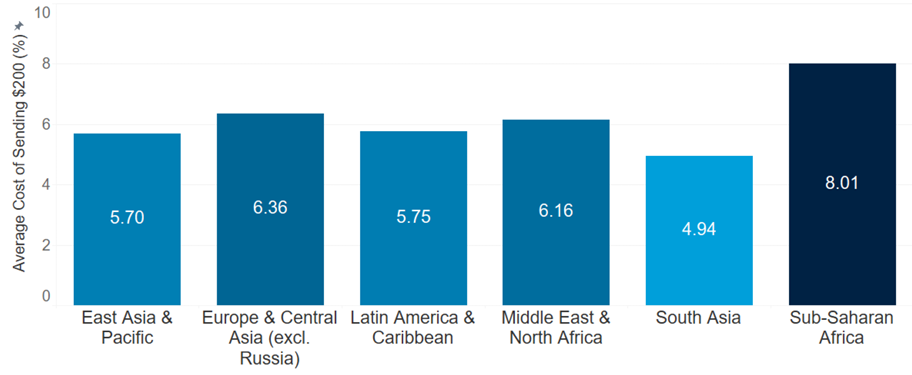

The cost of sending money in Africa is the highest in the world. The average cost of sending $200 from Africa is on average 8 percent, compared to the global average of 6.8 percent in 20227. Some countries show even higher costs: Tanzania (27%), Nigeria (19%), South Africa (14.7%), and Kenya (13.9%)8. The amount being transacted is subject to further reduction through low foreign currency exchange rates at the banks or remittance bureaus. Up to 5% of transaction value is lost during currency conversions8.

Figure 5.5. Average Cost of Sending $200 by Region

Source: Remittance Prices Worldwide Quarterly by World Bank

Whereas international wire transfer fees cost an average 7 percent of the total amount sent and could take several days to clear, some cryptocurrencies are designed to support foreign exchange and money transfers for less than a U.S. penny and process payments in 3 to 5 seconds9.

Figure 5.6. Cross-border Payment Fees on Africa’s Popular Crypto Trading Platforms

Source: Figure cited from THE Web 3.0 Connect -November '23 by EMURGO Africa8

In fact, Africa’s popular crypto trading platforms charge nearly 0 to at most 2 percent of transaction fee for $200 cross-border payment (see Figure 5.6). Even compared to money transfer agents like Flutterwave, Western Union, and Moneygram, which usually provide lower transaction fees than traditional bank transfers, crypto trading platforms provide users with much cheaper means of cross-border payments (see Figure 5.7).

Figure 5.7. Cross Border Remittance Cost of Web3 Services, Money Transfer Agents, and Banks in Africa

Source: Figure cited from THE Web 3.0 Connect -November '23 by EMURGO Africa8

Cryptocurrency transfers associated with remittance payments have experienced rapid growth, both in terms of value and volume, since the start of the COVID-199. Of the $48 billion remitted to sub-Saharan Africa (SSA) in 201910, Chainalysis estimates that up to $562 million worth of payments were facilitated by cryptocurrencies9.

According to a survey conducted in Nigeria, Ghana, Kenya, and South Africa, 61% of businesses are engaged in cross-border payments, but 48.4% use local banking partners, and only 19.5% use fintech solutions for cross-border payments11. The African electronic payments market is projected to reach $40 billion by 2025, growing at about 20% per year4.

Also, the number of immigrants from Africa residing outside the continent is expected to rise (9.5m by 2060), and there will be a continued demand for remittances8. As the SMES’ cross-border payments and immigrants’ remittances grow, the adoption of crypto assets is likely to persist. The appeal lies in its lower transfer fees and faster transactions than traditional methods8.

Notes

a. This is an insight shared by Shigeru Sato, the former Editor in Chief at Coindesk Japan. The insight is based on over 50 interviews he conducted with African blockchain startup companies from January to April 2023.

References

1. The Chainalysis 2023 Geography of Cryptocurrency Report | Chainalysis

2. The 2023 Global Crypto Adoption Index | Chainalysis

3. The cross-border payments opportunity for African small businesses | TechCabal

4. The future of payments in Africa | McKinsey

5. Free Currency Charts - Historical Currency Rates | Xe

6. 20 Million Indicators from 196 Countries | Trading Economics

7. Remittance Prices Worldwide Quarterly | World Bank

8. THE Web 3.0 Connect -November '23 | EMURGO Africa

9. Foresight Africa 2022 | Brookings

10. World Bank Predicts Sharpest Decline of Remittances in Recent History | World Bank

11. The cross-border payments opportunity for African small businesses | TechCabal

Thank you very much for reading this post 👽✨

For downloading the full report, visit this page.

Follow EMURGO Africa for more information

EMURGO Africa invests and supports local Web3 projects in the region to adopt Cardano’s decentralized blockchain technology to build socially impactful solutions.

As a regional entity of EMURGO, the official commercial arm of Cardano, EMURGO Africa also runs a local Cardano accelerator in Africa, Adaverse, which accepts applications year-round.

For more up-to-date information on EMURGO Africa, follow the official channels listed below.

About EMURGO Africa

- Official Website: emurgo.africa

- X: @EmurgoAfrica

- Telegram: https://t.me/emurgoafrica